Viewpoints

Industry insights, market outlook reports and commercial real estate

news, and trends from the Coldwell

Banker Commercial brand.

Not Your Mother’s Mall: Transforming the Modern Retail Center

Watching the latest season of Stranger Things, one cannot help but reminisce about the mall in its glory days. In the 1980s, the mall did to Main Street what the internet has done to almost all brick-and-mortar. All too familiar eye-grabbing headlines have now become commonplace when reading about today’s retail climate.

Micro-Breweries Quench a Thirst Across the U.S.

Americans have many ways to quench their thirst, from sodas to designer waters. A visit to a ballpark often doesn’t seem the same without a hot dog and a cold beer. While per capita beer sales have fallen 12% from 20091 levels, the number of craft breweries has exploded.

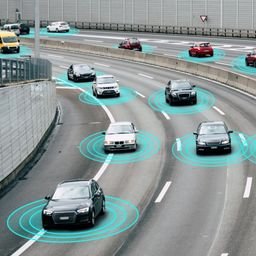

Are Driverless Cars Still Set to Impact CRE?

Driverless cars are everywhere. Now, the autonomous car trend is spreading across the world. So, we need to prepare for the changes that these vehicles could cause. Whether on the road or in your home, driverless cars will begin to affect your day-to-day life.

Will Online Ordering Be the End of Main Street Retail?

Today’s consumers want to ensure that their purchase makes a difference. Buying from a main street shop offers a connection to local business owners and artisans and gives consumers a real sense of their impact on their community.

Magnificent Mile to Main Street – The Transformation of Retail

According to a report from Reis, U.S. retail vacancies were at 10.2% at the end of 2018, a marginal increase from 10.0% a year earlier. Current market trends have challenged retail owners and investors with vacancies in retail spaces on Magnificent Mile, Fifth Avenue, and Main Street.

4 Tips for Vetting Potential Real Estate Deals

In today’s business climate, accurate and relevant information is crucial for commercial real estate investing success. You could be in real trouble if you don’t know the local market. Despite this fact, commercial real estate is a sector favorite among investors, with its relatively strong returns with only minimal to moderate risk.

4 Retail Real Estate Predictions for 2019 and the Future

We have been barraged by negative headlines this past year, of which company has filed for bankruptcy, or which mall is now a ghost town. However, it seems that experts in the industry think the retail sector is simply in a transitionary period where evolution is extremely important.

Brick and Mortar Grocery Responds to Amazon's Two-Hour Grocery Delivery

A few years ago, the grocery industry seemed like an untouchable horizon. How could e-commerce bore its way into an industry with such perishable, fragile, and heavy items? Impossible! Then, Amazon, as it often does, introduced Amazon Pantry and Amazon Fresh.

Coming to an Airport Near You: Another Amazon Play

Amazon has been an incredibly innovative force. In the past few years, they have revolutionized the e-commerce market, grocery shopping, checking out, and even the shipping industry. Now, they have moved on and targeted airports. They are looking into bringing their checkout-less stores to airports.

Stadiums Turn to Lifestyle Centers for Inspiration

No longer just a stand-alone structure looming in a too-large parking lot — they have amenities such as restaurants, hotels, shopping, clubs, kid zones, and more. But how did we get to this point, and why has this trend become so successful?