Marijuana’s Impact on Real Estate

A majority of adults in the United States currently have access to cannabis, whether medically or recreationally. As of this year, 19 states have legalized recreational cannabis use, while 39 states have legalized medical marijuana use. Over the years, the general perception of cannabis has evolved. Once seen as a danger to communities and to younger children, cannabis is now more readily available and marijuana sales produce taxable income for local economies.

For example, retailers in Colorado hit over $10 billion in marijuana sales since 2014, according to the Colorado Department of Revenue. Since 2014, cannabis in Colorado has generated $1.6 billion in fees and tax revenue alone. In this blog, we will explore the different ways cannabis is impacting the real estate industry.

Overall, the legalization of cannabis has benefitted commercial real estate. As explained by the Greater Capital Association of Realtors, real estate markets with fully legalized recreational marijuana attracts more homebuyers and renters, including marijuana consumers, entrepreneurs, and job seekers. Additionally, a survey by the National Association of REALTORS (NAR) revealed that “states where medical and recreational marijuana have been legalized for more than three years have seen more increases in demand for commercial properties.” As the NAR report indicates, 42% of those states saw an increase in demand for warehouses, a 27% increase in demand for storefronts and a 21% increase in demand for land.

Additionally, the demand for grow houses, which are properties dedicated to the growth and cultivation of marijuana plants, continues to increase. In fact, an NAR survey found that nearly 25% of realtors sold a grow house in states that legalized marijuana usage more than three years ago. Of that number, 75% reported that the grow house was not difficult to sell, and 85% had no title issues. The demand for Class-B and Class-C warehouses continues to grow as more people are using the space to store or grow cannabis.

People who are interested in investing in marijuana real estate can obtain up to 27,000 feet of vacant land to develop on with preliminary approval for cultivation, manufacturing & distribution of cannabis for $250,000. Considering the earning potential, a deal like this could be ideal for investors. However, it’s important to consider all the rules and regulations before investing in cannabis real estate. For example, marijuana is still illegal under federal law, which can complicate financing and banking activities related to marijuana.

A Trusted Guide in Commercial Real Estate

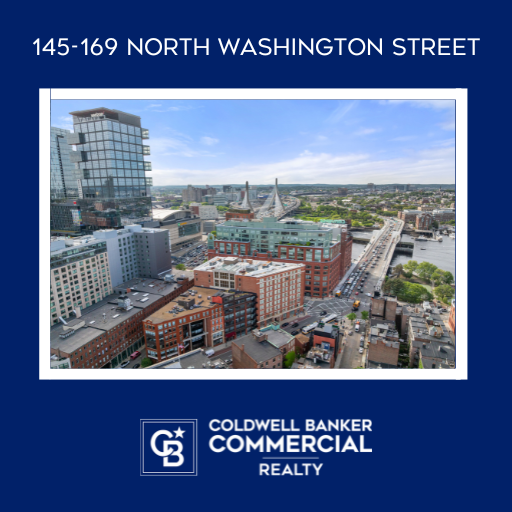

Coldwell Banker Commercial® provides Commercial Real Estate Services from Property Sales and Leases, to Property Management. Learn how our expansive network of Independently Owned and Operated Affiliates and Real Estate Professionals use their in-depth knowledge of the local market and industry trends to help businesses and investors navigate the complexities of the commercial real estate landscape.