Renters Struggled in 2021, Challenged by High Occupancy Rates, Low Supply, Surging Credit Scores

If the past two years since the onset of the COVID-19 pandemic seemed unfathomable, the impact was equally strange for renters. A report by RentCafe shows 2021 was a highly competitive year for renters in many areas as they faced a perfect storm: high demand, low apartment availability and applicants with top-notch credit scores.

In the most extreme situations, occupancy rates reached 98%, and more than 35 renters competed for a vacant apartment, which were snapped up quickly. Unprepared for this year’s soaring interest in apartments, small, outdoor-friendly markets became even hotter than popular renter hubs.

This year’s top three most competitive markets for renters were Eugene, OR, San Diego, CA, and Knoxville, TN, reports RentCafe in its annual Year End Report. Rental markets that were in high demand tended to be small metros, within proximity of nature that allow for an affordable lifestyle. Renters struggled to find an apartment in these markets, because they faced a combination of high occupancy rates (97% national average), limited supply, and extreme competition from roughly 30 applicants with solid credit scores vying for an apartment. The average time a unit remained vacant dropped to just two to three weeks.

Top 10 Most Competitive Rental Markets 2021

- Eugene

- San Diego

- Knoxville

- Central Coast

- Sacramento

- Providence

- Lehigh Valley

- Tacoma

- Wilmington

- Orange County

Nationally, rentals stood vacant for an average of 28 days in 2021. However, in some markets, that time was significantly lower. Apartments in Fayetteville, NC got leased up in 15 days. In Knoxville, TN and Pensacola, FL, apartments were occupied in 18 days.

The National Occupancy rate was 95% in 2021, reports RentCafe. Limited supply and availability made it tough for those seeking an apartment to find one. That explains why in markets such as Central Valley, CA and Fayetteville, NC, the occupancy rate soared to 97.9%. Those markets were followed closely by Central Coast (97.7%), Inland Empire (97.6%), Knoxville and Lehigh Valley (97.5% each).

American renters competed with 13 others for the same vacant apartment, on average. But RentCafe notes, some areas such as Knoxville, prospective renters competed with 36 others for an apartment. In Lehigh Valley, 34 renters competed for the same rental, while in Eugene, 30, in Central Valley and San Diego, 29 each.

Another facet of the competition for an apartment in 2021 was credit Score. Rental applicants this year had an average credit score of 640. RentCafe found several markets with higher-than-average scores, including North Jersey (707), Pittsburgh (685), Seattle (677), Long Island (673), East Bay (672), San Diego & Orange County (671 each).

Millennial lifestyle renters were a key segment that drove market demand this year. Despite earning higher incomes, they were forced to rent due to restrictive home prices.

As the pandemic lingers on, its effect on where and how people choose to live intensifies. Following last year’s trend, and despite the fast pace of recovery in the nation’s big cities, RentCafe says prospective renters continued to look for larger apartments close to nature this rental season. Locations that were able to accommodate the need for ample living spaces and easy access to outdoor attractions, which also had a limited supply of rentals, turned red hot this year.

Even with the vaccine rollout, office attendance remains limited, and many companies continue to push back dates when employees will be required to return to an office. That means many employees will continue to work from home all or most of the time. Now that homes have become the center of daily lives, it is understandable why the multifamily market emerged with so much competition for units and is expected to remain hot into the future.

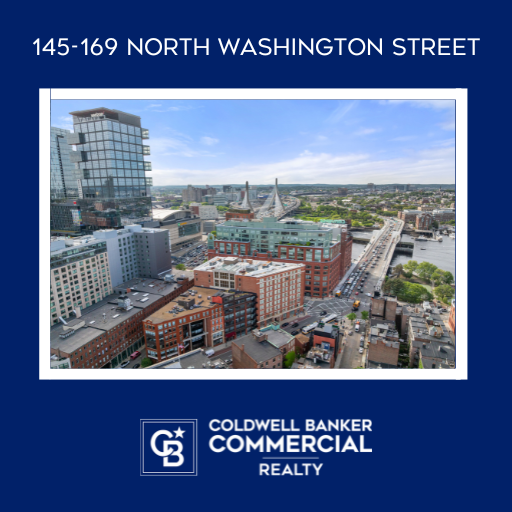

A Trusted Guide in Commercial Real Estate

Coldwell Banker Commercial® provides Commercial Real Estate Services from Property Sales and Leases, to Property Management. Learn how our expansive network of Independently Owned and Operated Affiliates and Real Estate Professionals use their in-depth knowledge of the local market and industry trends to help businesses and investors navigate the complexities of the commercial real estate landscape.