Record-Breaking Number of New Build-to-Rent Homes Are Hitting the Market

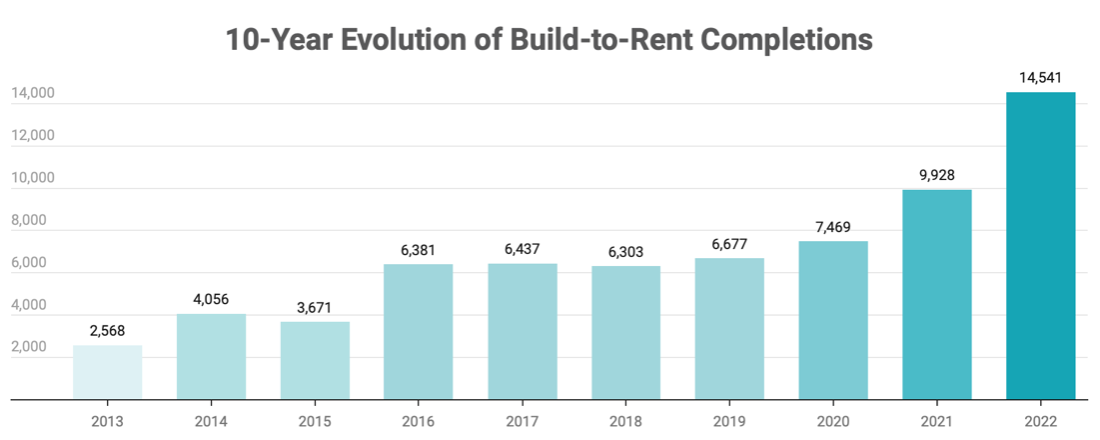

The effects of inflation are being felt across the country – especially by those wanting to buy a home. With consumer prices rising, home prices soaring, and rising interest rates, saving money to buy a home and being able to afford one is becoming increasingly challenging. Additionally, economic uncertainty and the turmoil in the real estate market are making consumers hesitant to make such significant financial commitments. Therefore, build-to-rent homes present an excellent choice for individuals who value the flexibility of renting, as it eliminates the responsibilities and expenses associated with maintenance while providing the comfort and privacy typically found in a house. According to data by RentCafe, developers are building new single-family rentals at a rapid rate. 2022 witnessed a remarkable milestone in the housing sector, with a record-breaking completion of 14,541 new homes, marking a substantial 47% increase compared to 2021. The surge in the build-to-rent (BTR) trend can be attributed to the lasting impacts of the pandemic, such as the adoption of social distancing measures and remote work models.

With 44,700 new BTR homes under construction across the nation, a staggering 97% occupancy level, (which is even higher than the 95% occupancy for apartments), it’s clear that this trend will only continue to rise in popularity. As explained by RentCafe, cities like Phoenix and Dallas have emerged as key hubs for rental homes, while Charlotte, NC; Atlanta, and Little Rock, AR, have experienced significant growth in single-family rentals over the past five years. In 2022, the construction of single-family homes for rent reached an unprecedented milestone, with over 14,500 completed houses, making it the strongest year on record. Additionally, in eight out of the top ten metropolitan areas for build-to-rent, the number of newly opened rental homes in 2022 reached its highest level in a decade. Notably, over the past two years, the scale and density of projects increased, with an average of approximately 130 units per property. Furthermore, the average size of each home also experienced growth, measuring 1,361 square feet in 2022, a 2.6% increase compared to the previous year.

As demonstrated in the graph above, Dallas emerged as the leading metropolitan area in terms of the highest number of completed single-family rentals in 2022, with nearly 2,800 homes. This figure represents a remarkable 10-year peak in the city. Notably, the number of build-to-rent homes that became available in the Dallas metro last year was more than five times greater than the 500 units completed just a year prior. Following Dallas, Phoenix takes the second spot on the list, with over 1,500 build-to-rent homes being completed in 2022. This number represents a 9% decrease compared to the previous year. Atlanta secures the third position, with over 800 single-family homes for rent completed in 2022, marking a significant milestone that hasn't been reached in the past decade.

As the popularity of build-to-rent (BTR) homes continues to soar, it will be fascinating to observe which cities seize the opportunity to construct and expand new single-family rental properties, considering the surging demand. Notably, prominent figures such as Elon Musk and Jeff Bezos have recognized the potential and are investing in single-family homes, as their value is expected to appreciate over time due to the increasing popularity and necessity of such properties. The attraction of single-family build-to-rent (BTR) communities for institutional investors is due to the housing shortage and the fact that these communities function similarly to multifamily properties. Investors find them appealing due to their remarkable lease renewal rates and the broad appeal they hold for a diverse range of renters. Additionally, consumers favor these communities as they often feature high-quality properties that provide a single-family residence experience.

A Trusted Guide in Commercial Real Estate

Coldwell Banker Commercial® provides Commercial Real Estate Services from Property Sales and Leases, to Property Management. Learn how our expansive network of Independently Owned and Operated Affiliates and Real Estate Professionals use their in-depth knowledge of the local market and industry trends to help businesses and investors navigate the complexities of the commercial real estate landscape.