Coldwell Banker Commercial

ABOUT

The Coldwell Banker Commercial® brand(CBC) is a worldwide leader in the commercial real estate industry, and is part of the oldest and most respected national real estate brand in the country, Coldwell Banker Real Estate. Coldwell Banker Commercial is an Anywhere (NYSE: HOUS) brand, a global leader in real estate franchising and provider of real estate brokerage, relocation and settlement services.

Recent articles

-

News

NewsAJ Thoma III, CCIM, SIOR, Earns Rare SIOR Dual Endorsement

Coldwell Banker Commercial Devonshire Realty proudly announces that AJ Thoma III has earned the prestigious SIOR Dual Endorsement for office and industrial real estate, a distinction held by only 181 professionals globally. Thoma, a top producer with over $265 million in transactions, continues to lead in Central Illinois commercial real estate.

-

News

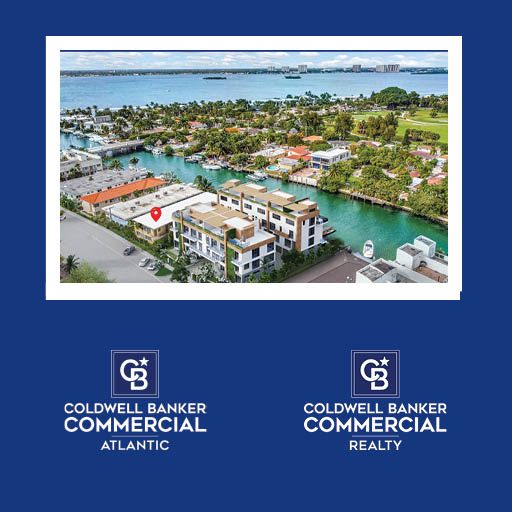

NewsColdwell Banker Commercial Realty And Coldwell Banker Commercial Atlantic Facilitate Sale of 10-Unit Multi-Family Property in Miami Beach, Fla.

Coldwell Banker Commercial Realty and Coldwell Banker Commercial Atlantic successfully brokered the $2.78 million sale of a multi-family property at 2025 Calais Drive in Miami Beach's Normandy Isle. The buyer, 2D Homes LLC, plans to develop the property into a thriving multi-family rental community, meeting the high demand for quality rental units in the area.

-

Industrial

IndustrialIndustrial Real Estate Boom: How E-commerce Is Fueling Warehouse Expansion

CBC explores how the e-commerce boom is driving unprecedented growth in the industrial real estate sector, with giants like Amazon and Walmart leading the demand for logistics facilities. Learn about the challenges and innovations shaping this dynamic market, from automation to eco-friendly designs.

-

News

NewsHoliday Inn & Suites in Monterey Park, Calif. Sells For $38M, Part of La Metro Revitalization Plans

Coldwell Banker Commercial George Realty successfully brokered the $38 million sale of the newly constructed Holiday Inn & Suites at 400 S. Atlantic Blvd. in Monterey Park. This 136-room hotel, part of the Atlantic Times Square project, enhances the rapidly developing area with its modern amenities and prime location.

-

News

NewsColdwell Banker Commercial Read & Co. Completes $6m Sale of Forest Hill Shopping Center in Lynchburg, Va.

Coldwell Banker Commercial Read & Co. successfully brokered the $6 million sale of Forest Hill Shopping Center in Lynchburg, VA, a prime 82,000 sq. ft. value-add property. The new owner, Swintstorage Conversion Fund, LLC, plans to transform the space into a mixed-use facility with indoor and outdoor storage, including RV and boat storage.

-

Property Management

Property ManagementSmart Buildings: How Technology Is Revolutionizing Property Management

Coldwell Banker Commercial looks into how smart building technology is transforming commercial real estate (CRE) by enhancing efficiency, tenant satisfaction, and sustainability. Learn about the role of IoT, AI-driven systems, and smart energy management in revolutionizing property management.

-

News

NewsAJ Thoma III, CCIM, SIOR, Facilitates $17.5M Sale of Country Financial Campus to Illinois State University for Future Engineering Campus

AJ Thoma of CBC Devonshire facilitated the sale of 400,000sf of office space in three buildings for $17.5M to Illinois State University

-

Office

OfficeCo-Working Spaces and the Shift Toward Flexibility in Commercial Leasing

Discover how the post-pandemic commercial leasing landscape is evolving, with co-working spaces becoming mainstream and traditional landlords adapting to meet modern business needs. Learn about the benefits and challenges of flexible leasing models in our latest blog post.

-

News

Prime Los Angeles-Area Multifamily Investment Properties with Significant Rental Growth Potential Sold for $14.2m

Coldwell Banker Commercial West successfully marketed and sold two multifamily properties in Bellflower, California for $14.2 million. Representing both the seller and buyer, Tom Papoulias highlighted the significant rental growth potential of the 1959-constructed buildings, which attracted six offers within 10 days.

-

Trends

TrendsThe Trend Report: Fall 2024

Coldwell Banker Commercia's Trend Report Fall 2024 highlights the evolving housing market dynamics, driven by low mortgage rates and millennial homebuyers, leading to increased home prices and a strained rental market. It underscores the regional variations in supply, demand, and rental preferences, emphasizing the need for builders to create community-focused, home-like living spaces.