2022 OUTLOOK: Expect Another Strong Year

Strong fundamentals fueled by stable cash flows and pent-up demand

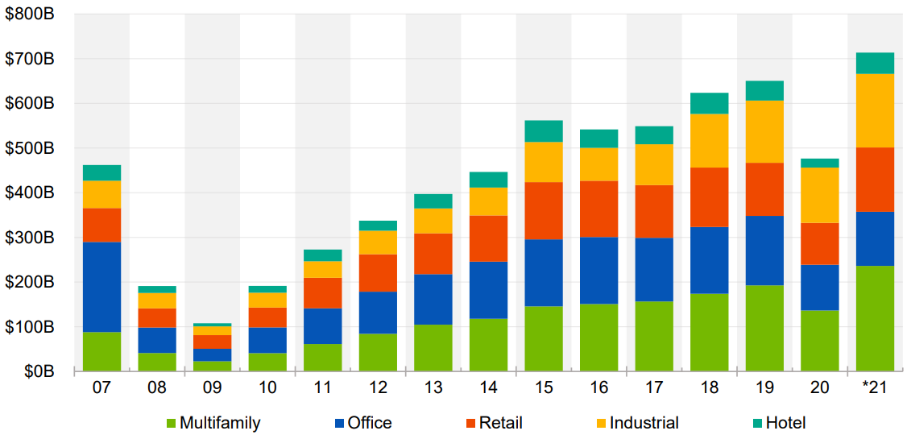

While rents were pressured early in the COVID-19 pandemic as tenants returned space to the market and delayed new leases, the economy came roaring back in 2021 with 18.5M jobs (out of 22.4M lost during the pandemic according to the Bureau of Labor Statistics) - contributing to confidence in the property market and helping to push commercial property values to a 15-year high in the third quarter. 2021 transaction volumes rose 55% over 2020 and were 15% above 2019, led by multifamily, lif e-science, warehouse and distribution properties.

Exhibit 1: Annual CRE Sales Volume, by Property Type

Source: Costar (YTD as of December 8, 2021)

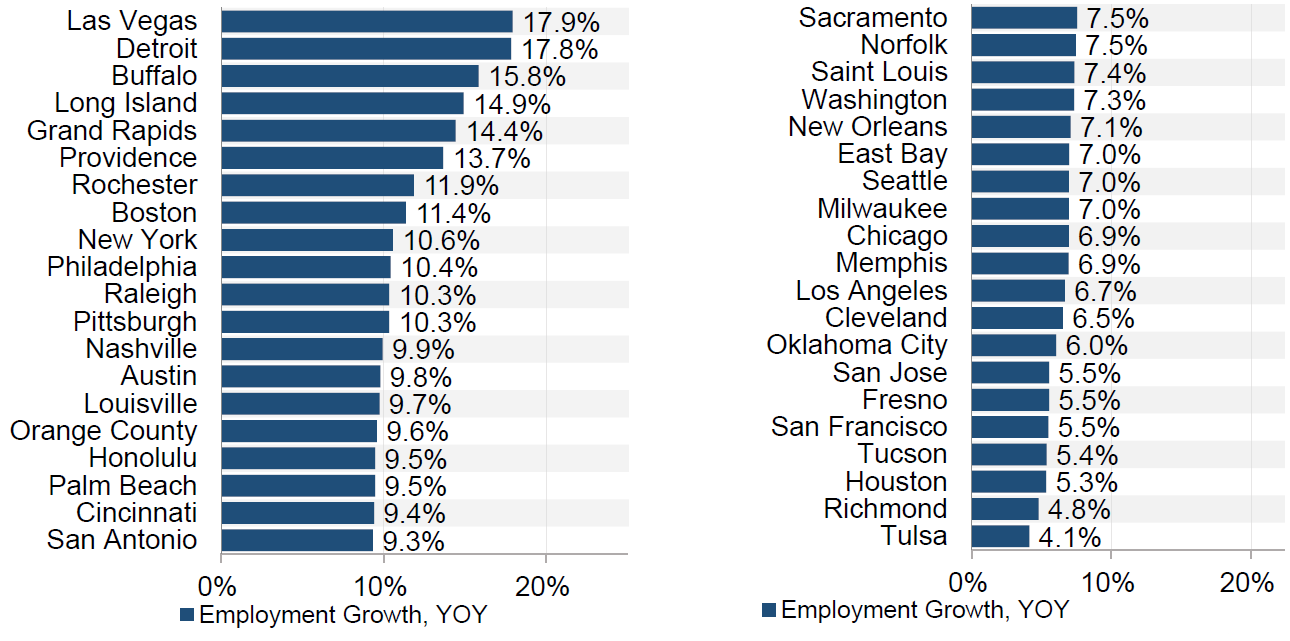

Fundamentals are strong Corporate relocations, local business expansions and an inf lux of new residents have fueled job growth and demand for commercial real estate space in secondary markets. Investable funds are piling up and waiting to be deployed as investors f ind it challenging to identify product to acquire.

Exhibit 2: Job Change by Market (through November 2021)

Source: Bureau of Labor Statistics, Oxford Economics, Costar

For the year ahead, we expect CRE activity to continue at a healthy clip, as investors capitalize on rising rents and demand for space. While deal f low for Class A office properties is starting to pick up in major metros (Seattle, D.C., L.A., San Francisco, New York), focus on smaller markets experiencing population and employment growth will continue to be front and center. The key challenge that buyers will face this year is deciding if there is enough rent growth to justify extremely low cap rates. For sellers the question is, what to do with the money if they sell now.

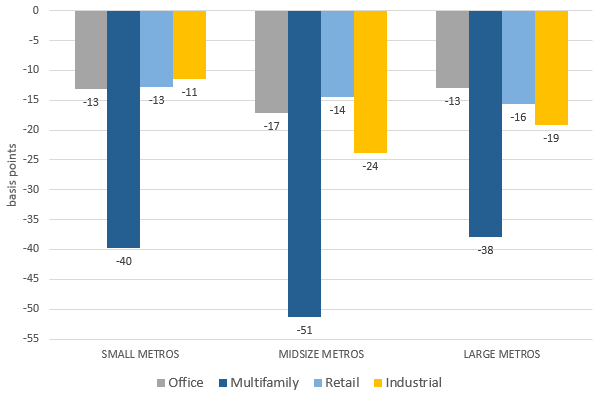

Core Trends Cap rates in popular Sun Belt and secondary markets have come down to the 2% to 4% level, creating some of the tightest spreads between coastal and non-coastal markets for popular industrial and multifamily properties.

Exhibit 3: Cap Rate Change from 1Q20 (pre-pandemic)

Source: CBC Research, ISN, US Census Bureau (2015-2020), CoStar

Investors who rarely ventured outside of their preferred geographies pre-pandemic are now looking at properties across the country and considering all of it "fair game". For example, West Coast developers are looking to cross into markets like Montana, Boise, Las Vegas and Arizona.

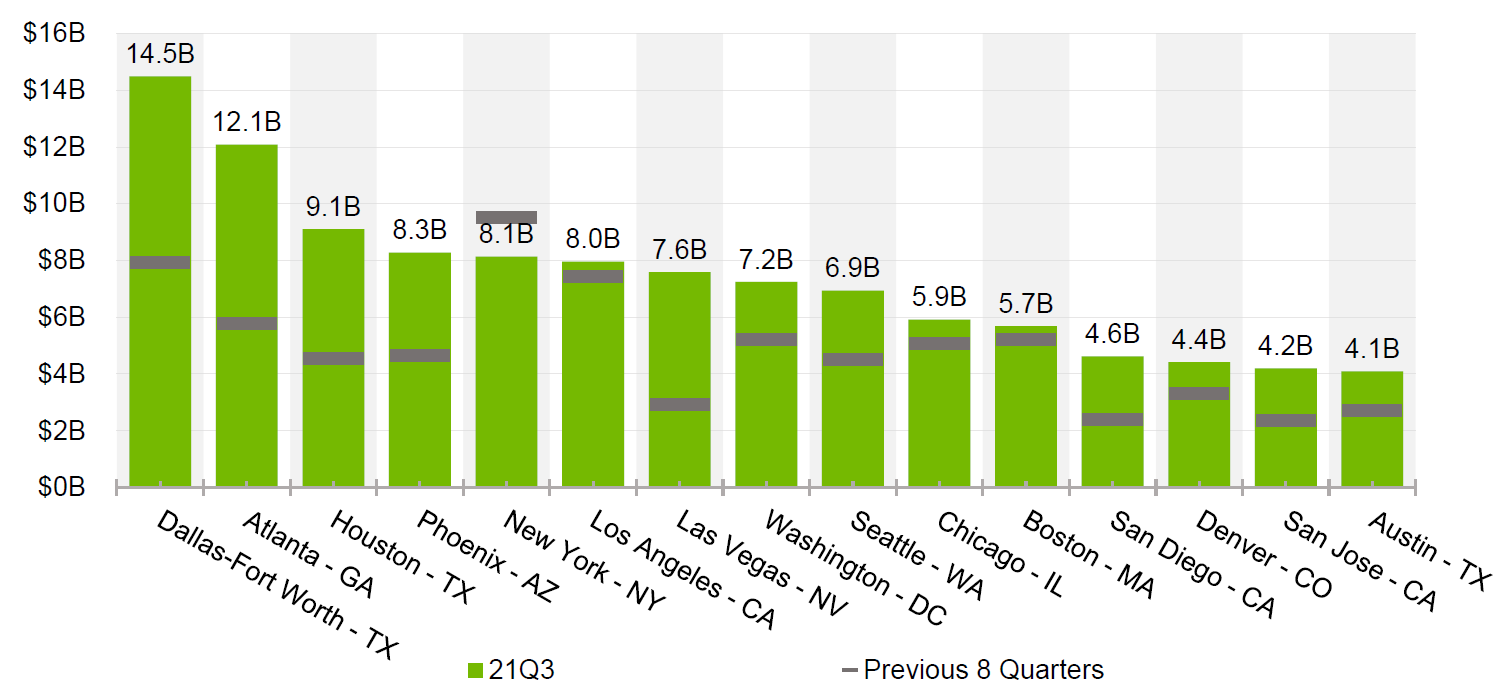

Institutional investors are building industrial spec properties across the South and Midwest where rents have increased significantly. Retail landlords are readily signing short-term leases for high-credit tenants and essential businesses. 1031 exchange buyers are paying premiums for triple-net assets to lock in deals. Demand for residential development land, particularly build -to-rent communities, is intensifying. And small private investors are looking to buy anything with the most potential for growth. Outside of rural land, our commercial professionals are seeing very steady cash flows streaming in almost every sector.

Exhibit 4: CRE Sales Volume & Investment Surge, by Market

Source: CoStar (includes Multifamily, Office, Retail, Industrial, Hotel)

Build-to-Rent is the new Multifamily Build-to-rent single family homes have prominently made its way into many secondary markets. The pandemic-driven demographic shift away f rom crowded cities have led investors and developers to aggressively go after the growing demand for this product across all age groups - oftentimes buying out tracts of land at prices only they could afford. Build -to-rents not only provide another channel for more homes, they also offer a better value proposition over multifamily buildings with higher-quality renters that turnover less frequently and can better absorb rent increases. Expect demand for land to grow further this year as it is a vital piece of the BTR process.

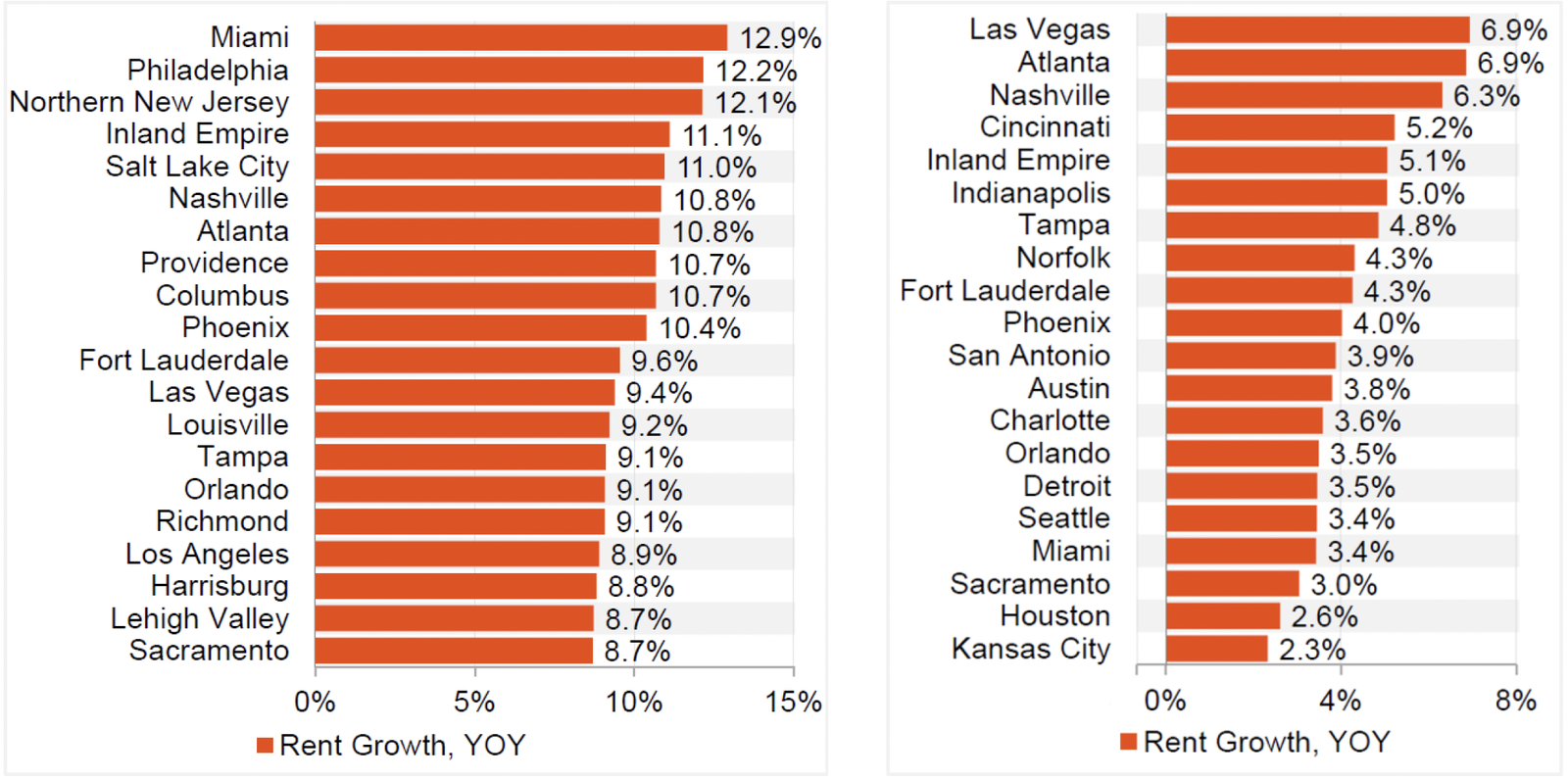

Exhibit 5: Multifamily Rent Growth, by Market

Source: CoStar data through December 2021

Note: Includes markets with 75K+ units inventory

Exhibit 6: Industrial Rent Growth, Top Markets / Exhibit 7: Retail Rent Growth, Top Markets

Source: CoStar data through December 2021

Note: Includes markets with 100M+ SF inventory.

Big office occupiers waiting on large-scale return While most tertiary markets never saw a downturn in office demand, high-rise leasing activity remains very weak across the country. Landlords are keeping rents high but offering generous concessions. With most people still working from home, a lot of companies have paused leasing decisions except those with pending expirations. While some firms are taking advantage of the weak market to upgrade their space, many are downsizing their footprint as workers rotate coming in twice a week. Despite higher foot traffic now versus six months ago, the majority of businesses are still figuring out whether to return fully or adopt a hybrid plan. Occupiers will have the upper hand in large metros until elevated vacancy rates come down. As businesses finalize their return-to-work policies over the next few months, expect investors to come back to this space aggressively, targeting high occupancy buildings with high quality tenants first. Interest in Class B and C properties will ramp up once Class A cap rates begin to compress.

Small office space is healthy While rents did not go up, occupancy in small office buildings and markets stayed very stable throughout the pandemic (despite month-to-month leases) led by medical, life-science labs, accounting, insurance, and real estate professionals. Companies like Google, Target and Zillow are also embracing smaller hubs for in-person meetings in addition to their large campuses. As flexible work schedules and leases become standard, expect demand and rents for smaller/alternative office space to go up in 2022.

Self-storage to remain strong The trend toward remote working prompted many families to relocate over the past 18 months and businesses to cut office space and overhead costs - both of which created new demand for self -storage in many markets across the country. This greater need for extra space and longer holding periods has pushed self -storage occupancy rates and rents to record highs in 2021. Looking ahead, we expect these properties to offer strong and steady cash f lows with very low maintenance compared to other types of commercial assets.

Medtail to remain a staple With more hospital consolidations to come in the years ahead, the need for medical services to be close to the consumer is growing. To make healthcare more accessible, providers have been setting up offices, clinics and urgent care centers throughout the neighborhoods they serve, specifically securing space in strip centers and small shopping malls for far less rent than what hospitals and office buildings charge. Demand for medical space in 2021 accelerated as vaccinations were rolled out and patients who deferred care last year returned. Leasing activity picked up dramatically as physicians planning to retire looked to monetize their real estate while younger physicians were joining big practice groups in droves (driving demand for large leasable space). While cap rates have compressed over the past year, medical office property still remains one of the most attractive assets due to its strong and stable income stream.

Conclusion Looking ahead to 2022, we expect to see another year of strong growth led by the rise of smaller spaces and suburban office leases; capital infusion into the single-family rental market; and continued demand for warehouses, distribution centers and net-leased retail. Expect investment in office properties to ramp up for the right assets in the right markets. Cap rates will likely stay low and compress further on high-quality product as owners continue to hold onto property because they can't f ind a better alternative to trade into. Question is: how low do cap rates need to go before financing becomes a burden? We are likely approaching the end of the "easy money" era and will need to rely on higher rent growth going forward. As with any business decision, the outlook for a specific property or property type depends on a variety of national and local conditions. Contact a commercial real estate professional to evaluate a particular situation.

Jane Thorn Leeson is a Research & Resources Analyst with Coldwell Banker Commercial.

Coldwell Banker Commercial®, provides commercial real estate solutions serving the needs of owners and occupiers in the leasing, acquisition and disposition of all property types. With a collaborative network of independently owned and operated affiliates, the Coldwell Banker Commercial organization comprises almost 200 companies and more than 3,000 professionals throughout the U.S. and internationally.

Updated: January 10, 2022

A Trusted Guide in Commercial Real Estate

Coldwell Banker Commercial® provides Commercial Real Estate Services from Property Sales and Leases, to Property Management. Learn how our expansive network of Independently Owned and Operated Affiliates and Real Estate Professionals use their in-depth knowledge of the local market and industry trends to help businesses and investors navigate the complexities of the commercial real estate landscape.